Welcome to Divyam securities

Smart Investing.

Secure Future.

At Divyam securities, we help you make informed investment decisions with confidence. From wealth creation to long-term financial security, we’re committed to guiding you at every step of your journey.

AUM Growth Excellence Award

2022

Highest AUM Growth Award

2026

Since the beginning of my investment journey, Divyam securities has supported me with personalized guidance aligned to my goals, risk appetite, and financial strength.

300+ Reviews

0+

Years of Experience

0+

Trusted Families

ABOUT US

Your Trusted Partners in Wealth Creation

Whether you are beginning your investment journey or planning for long-term financial milestones, our experienced team is committed to providing clear guidance and personalized strategies that align with your goals, risk profile, and aspirations.

SEBI

Compliant

AMFI

Registered

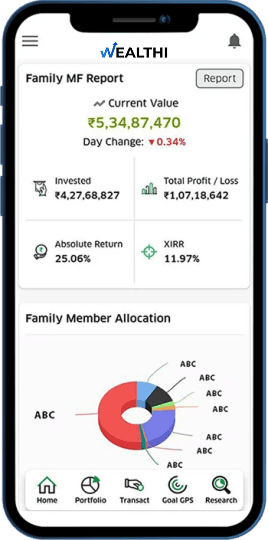

700 Cr+

AUM Handled

10 +

Years of Experience

WHY MUTUAL FUNDS

Build long-term wealth through professionally managed mutual fund investments.

Higher Potential Returns Over the Long Term

Compared to traditional savings options like FD, mutual funds have the potential to deliver better potential returns over time.

Managed by Experts

Every fund is backed by professional fund managers who track the markets daily, research opportunities, and make smart decisions on your behalf.

Wide Variety: Equity, Debt, Hybrid

No matter your goal: growth, safety, or a balance of both, there’s a mutual fund that fits your needs.

Start Small, Grow Big

You don’t need a large sum to begin. With SIPs starting as low as a few hundred rupees, you can start your investing journey.

Direct Vs Regular Investing

Why Choose an MFD?

You can choose funds on your own. Or you can work with someone who does this every day — and helps you avoid big mistakes.

Different Assets

Choose Your Investment Option

Compare popular investment options side by side and see how much more you can potentially earn by investing in different assets.

Saving Account

₹ 6,90,750

(with 3% return)

Fixed Deposit

₹ 8,23,494

(with 6% return)

Gold

₹ 9,74,828

(with 9% return)

Mutual Fund

₹ 13,10,457

(with 14% return)

LEARNING CENTER

Resources to help you get started

SIP vs. Lump Sum Investment: Which is Right for You?

Navigating the world of investments isn't as simple as it may seem. It requires careful consideration of your financial ...

Term Life vs. Whole Life Insurance: Understanding the Difference

New to investing? This beginner-friendly guide explains mutual funds, how they work, and why they’re ideal for long-term...

Understanding Risk and Return in Investments

Secure your golden years by starting your retirement planning in your 30s. Learn how compounding and SIPs can help....

START INVESTING

Let’s Take a Step Towards Your Dreams - Today!

Call for Inquiry

+91 9888992788Send us email

divyamsecurities@gmail.com